Maryland Property Tax

Property Tax - Marylandtaxes.gov

Property Tax The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland. Maryland's 23 counties, Baltimore City and 155 incorporated cities issue property tax bills during July and August each year.

https://www.marylandtaxes.gov/individual/property/index.php

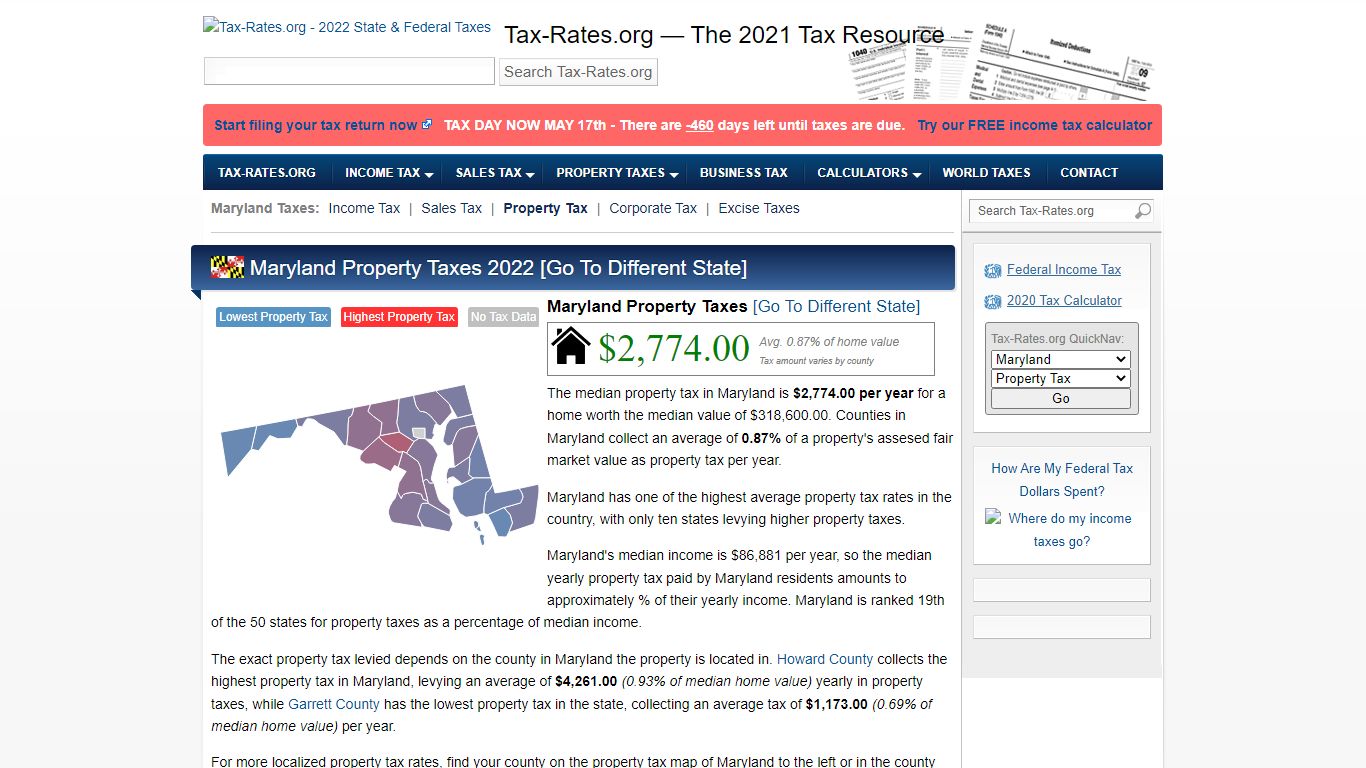

Maryland Property Taxes By County - 2022 - Tax-Rates.org

Maryland Property Taxes [Go To Different State] $2,774.00 Avg. 0.87% of home value Tax amount varies by county The median property tax in Maryland is $2,774.00 per year for a home worth the median value of $318,600.00. Counties in Maryland collect an average of 0.87% of a property's assesed fair market value as property tax per year.

https://www.tax-rates.org/maryland/property-tax

Real Property - Maryland Department of Assessments and Taxation

The property tax is primarily a local government revenue. Counties and cities depend on the property tax and a portion of the income tax to make up their budgets. View the property tax rates in your area.

https://dat.maryland.gov/realproperty/Pages/default.aspx

Marylandtaxes.gov | Welcome to the Office of the Comptroller

Comptroller of Maryland's www.marylandtaxes.gov all the information you need for your tax paying needs

https://www.marylandtaxes.gov/

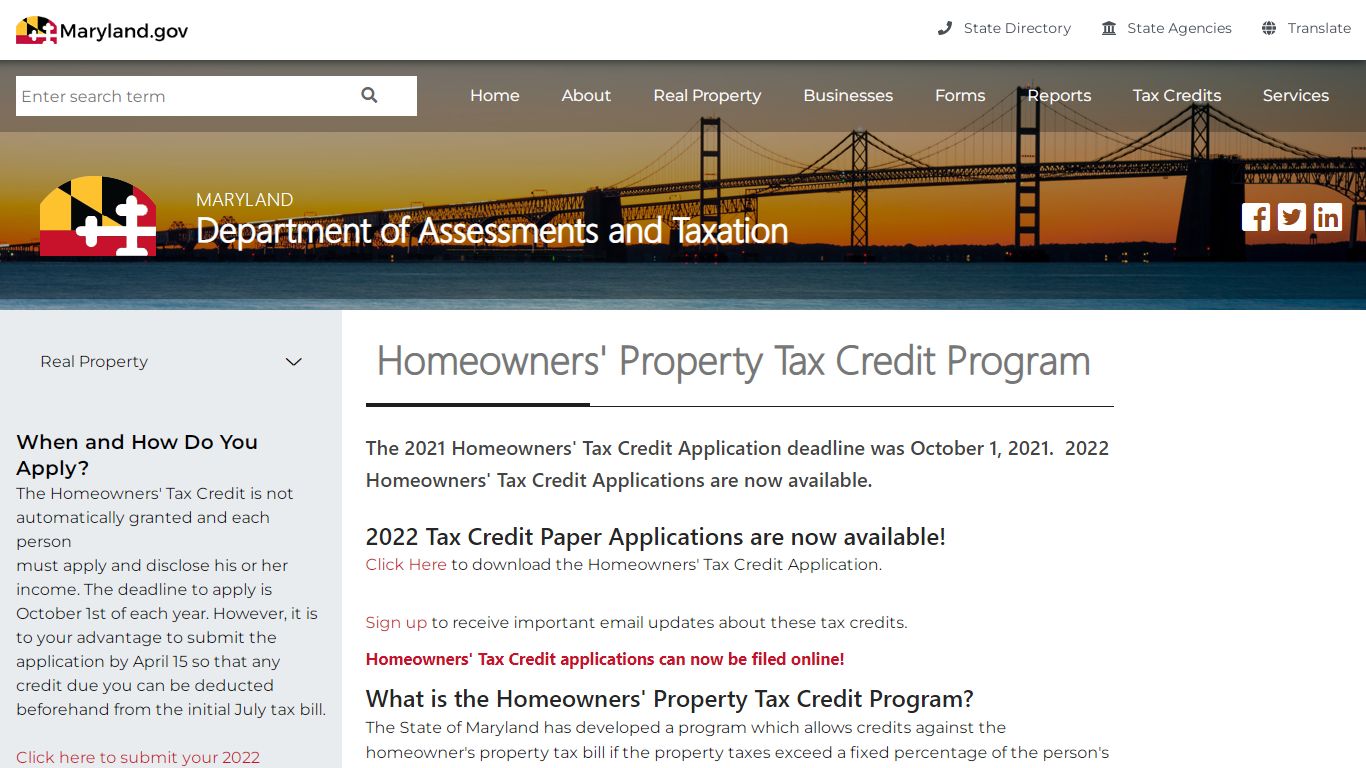

Homeowners' Property Tax Credit Program - Maryland Department of ...

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula: 0% of the first $8,000 of the combined household income; 4% of the next $4,000 of income; 6.5% of the next $4,000 of income; and 9% of all income above $16,000. The chart below is printed in $1,000 ...

https://dat.maryland.gov/realproperty/Pages/Homeowners\'-Property-Tax-Credit-Program.aspx

News and Announcements - Maryland Department of Assessments and Taxation

Sign Up for Important Email Notices - All entities must submit an Annual Report and Personal Property Tax Return every year to remain in "good standing" and legally operate in Maryland. Homeowners' and Renters' Tax Credit applications must be submitted every year.

https://dat.maryland.gov/Pages/default.aspx

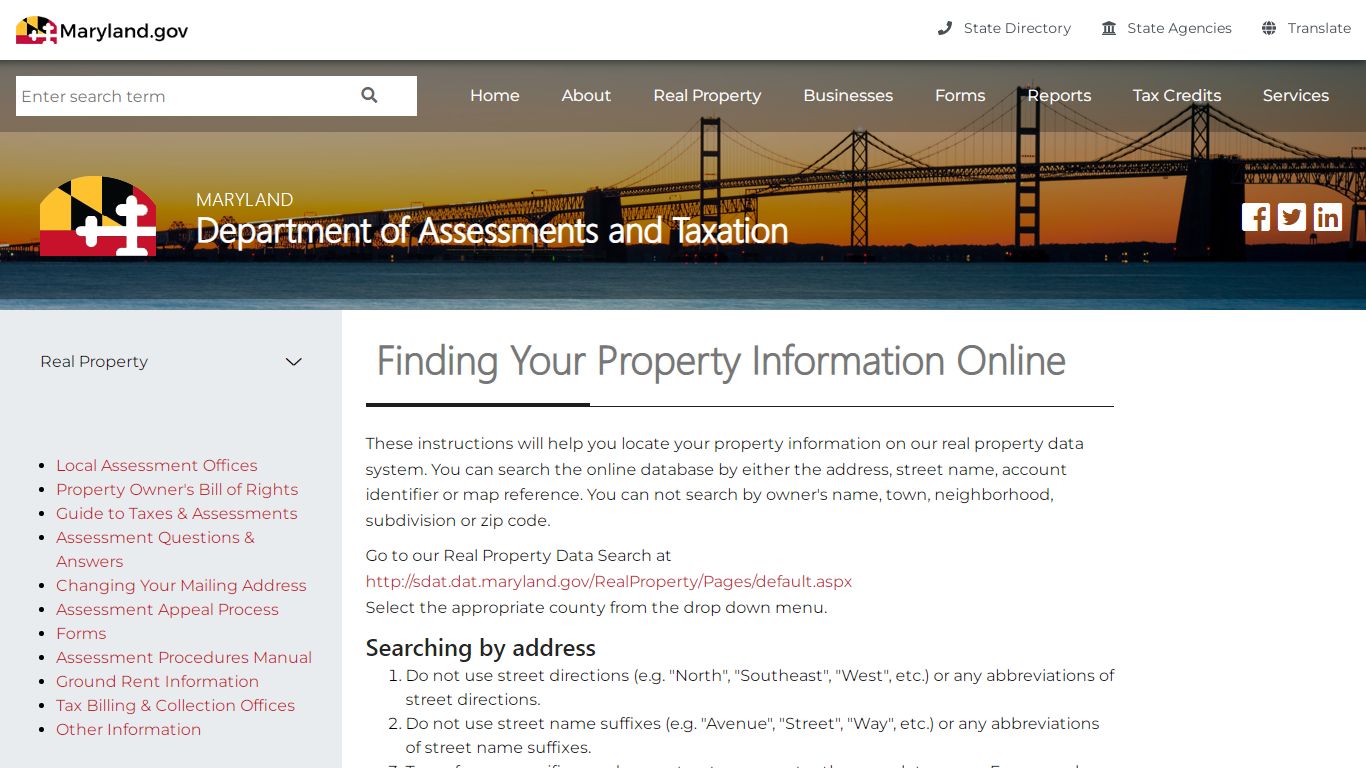

Finding Your Property Information Online - Maryland Department of ...

State of Maryland Department of Assessments and Taxation GARRETT COUNTY PO BOX 388 OAKLAND, MD 21550-0388 Anne Arundel County: Following the ACCT# 02 are the two digit assessment district, the three digit subdivision code and the 8 digit account number. You will need the district, subdivision, and account numbers to search for your property

https://dat.maryland.gov/realproperty/Pages/Finding-Your-Property-Information-Online.aspx

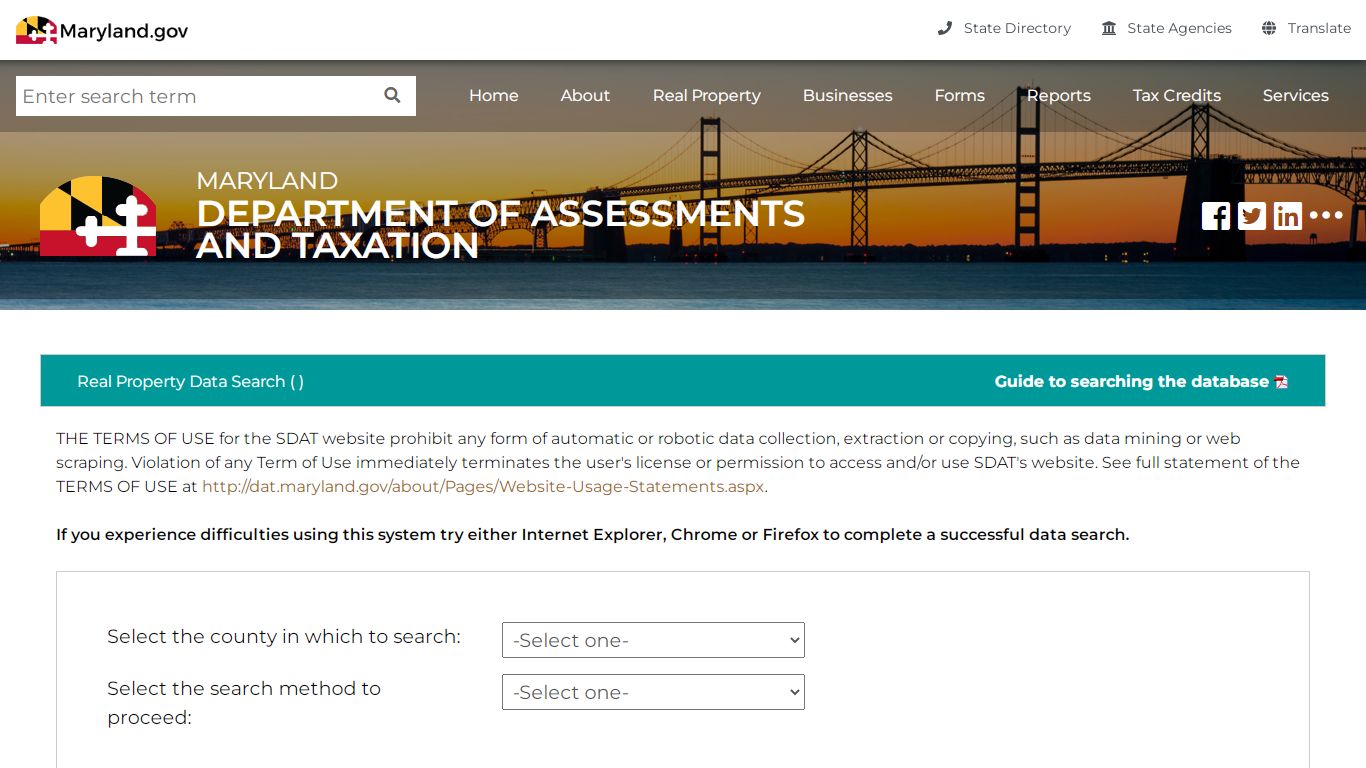

SDAT: Real Property Data Search< - Maryland Department of Assessments ...

Select the county in which to search: The Real Property Search Page may be unavailable before 7:00 AM for maintenance. Please plan accordingly. This screen allows you to search the Real Property database and display property records. Click here for a glossary of terms. Deleted accounts can only be selected by Property Account Identifier.

https://sdat.dat.maryland.gov/RealProperty/Pages/default.aspx

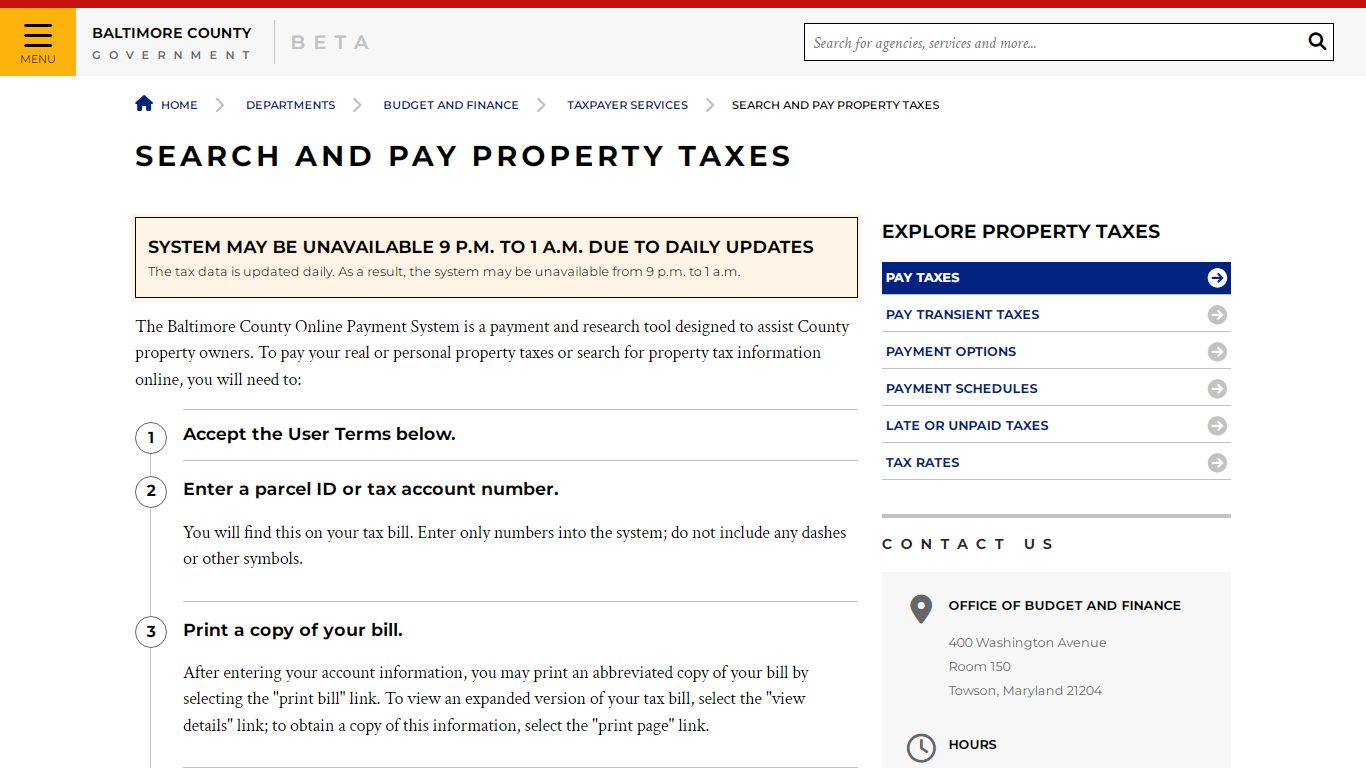

Search and Pay Property Taxes - Baltimore County, Maryland

To pay your real or personal property taxes or search for property tax information online, you will need to: Accept the User Terms below. Enter a parcel ID or tax account number. You will find this on your tax bill. Enter only numbers into the system; do not include any dashes or other symbols. Print a copy of your bill.

https://www.baltimorecountymd.gov/departments/budfin/taxpayerservices/taxsearch.html

What Happens If I Don't Pay Property Taxes in Maryland? | Nolo

How to Stop a Property Tax Sale in Maryland. If you want to stop a Maryland property tax sale from happening, you must pay the overdue amounts. Again, you'll get 30 days' notice that the property will be sold if the arrears, interest, and penalties aren't paid. (Md. Code Ann., Tax-Prop. § 14-812.) Notice After a Maryland Property Tax Sale

https://www.nolo.com/legal-encyclopedia/what-happens-if-i-don-t-pay-property-taxes-in-maryland.htmlYour Taxes | Charles County, MD

The State Department of Assessments and Taxation determines the taxable assessment of your real property. It is important to verify any assessment notices received from the SDAT for accuracy. Assessments may be appealed. For more information please call 301-932-2440. Tax rates are set each fiscal year.

https://www.charlescountymd.gov/government/fiscal-and-administrative-services/treasury-taxes/your-taxes/